The information provided here is part of Export import business Course online

Amendment of description of goods in Import General Manifest

Now, let me explain about the importance of amending description of goods in IGM and formalities and procedures to amend description of goods in Import General Manifest.

Amendment of description of goods in IGM is done rarely with some of traders in international business. If the description of goods filed wrongly, the amendment of description of goods in Import General Manifest can be done with necessary documentation procedures and formalities with respective customs department of each country.

Why does the importer or shipper need to amend the details of description in Import General Manifest?

The description of goods mentioned in the IGM may not have classified in the tariff of harmonized system accepted all over the world against which assessment of goods has to be carried out by customs of each country. The description of goods mentioned in IGM has to be matched with the HS Cod or ITC code for valuation and inspection of goods by customs authorities.

Wrong filing of IGM can also happen by oversight filing. So, before shipping of goods, exporter needs to know the HS code of each product he exports, so as to enable to mention the same description in all pertaining documents which helps buyers at importing country. Mentioning HS code number in all related documents is a good practice of documentation to avoid any further clarification at importing country for necessary import customs clearance procedures and formalities.

A No Objection Certificate has to be obtained from the original shipper of goods pertaining to the amendment of description of goods in IGM. The said amendment of description of goods has to be effected in all related documents like Bill of Lading or Airway Bill, invoice, packing list and other related documents before amending IGM with customs.

Customs authorities of most of countries allow amendment of description of goods, subjected to their satisfaction on the subject matter along with necessary declaration, undertaking and supporting documents wherever applicable.

I have explained about the reasons to amend description of goods in Import General Manifest and the procedures to amend description of goods mentioned in IGM and other shipping documents to take delivery of imported goods at destination customs location. Have you experienced in amending description of goods in an IGM under your import goods? Do you wish to add more information about amendment of description of goods in Import General Manifest?

The information provided here is part of Export import business Course online

Share below your experience about amendment of IGM. Comment below your thoughts and discuss about this article – How to amend description of goods in Import General Manifest.

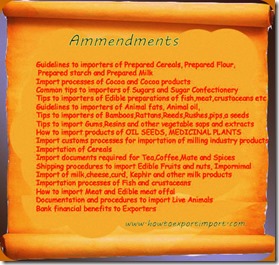

Other details on how to import export

Procedures to file IGM (Import General Manifest)

Amendment of weight in Bill of Lading

Difference between importer and Consignee

How IGM is filed under high sea sale

Difference between Demurrage and Detention in import

How to start Export Business?

How to get Export Orders?

What are the risks and solutions in Export Business?

Click here to know India Trade Classification(ITC)

Click here to know HS code of other product/commodity

Service Tax - Click here to read complete notification under Budget 2014

What is Bank post shipment credit to exporters?

Types of export containers

Measurement of export containers

Export Import Policy of India 2015-20

MEIS, Merchandise Exports from India Scheme

SEIS, Service Exports from India Scheme

Merge your Commercial Invoice and Packing List for all your future exports

Export procedures and documentation