Wrong spelling in LC documentation

Is ‘spelling wrong’ a problem in documents under Letter of Credit? What is the consequences if documents with spelling errors in LC. Does bank reject documents if wrong spell in documents under Letter of credit? These questions are common in import export trade.

Is ‘spelling wrong’ a problem in documents under Letter of Credit? What is the consequences if documents with spelling errors in LC. Does bank reject documents if wrong spell in documents under Letter of credit? These questions are common in import export trade.

Let us find solution on above questions, Does spelling errors in documents under letter of credit make problems in receiving LC amount by seller from buyer.

I have specifically mentioned in my other articles in the same website about the importance of proper care in documentation under LC terms including spelling error, punctuations, coma etc.

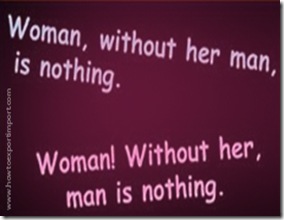

Let me tell you with a short story about importance of a ‘punctuation’. This example perfectly serves the answer for this article.

It is said that in a verdict, Judge declared his judgment orally by saying – “Kill him not, let him free”. But the clerk who has taken dictation has written the verdict in file as – “Kill him, not let him free”. The accused has been killed based on the written statement – “Kill him, not let him free”, although the actual judgment was to leave the accused free.

Let me come back to our question – whether spelling error or punctuation in documentation in Letter of Credit is a discrepancy.

Terms and conditions of a Letter of Credit (LC) is adopted by Banks all over world based on the guidelines of UCP 600 (Uniform Customs and Practice for Documentary Credit 600) by International Chamber of Commerce. As per UCP 600, Any error in presentation, spelling, punctuation, signatures, stamps or any other discrepancy bank can find, is a discrepancy of documents under Letter of Credit. However, apparent spelling mistake, punctuations etc. in documentation under Letter of Credit which do not alter the meaning, specification, description, value of goods, quantity or any other contents can be acceptable by bank without treating as a discrepancy of documents. However, if bank found such spelling error or punctuation as a ‘discrepancy’, the beneficiary can contact the opener either by fax or email and request him to advise opening bank to accept documents by overlooking and waiving such discrepancies.

based on the guidelines of UCP 600 (Uniform Customs and Practice for Documentary Credit 600) by International Chamber of Commerce. As per UCP 600, Any error in presentation, spelling, punctuation, signatures, stamps or any other discrepancy bank can find, is a discrepancy of documents under Letter of Credit. However, apparent spelling mistake, punctuations etc. in documentation under Letter of Credit which do not alter the meaning, specification, description, value of goods, quantity or any other contents can be acceptable by bank without treating as a discrepancy of documents. However, if bank found such spelling error or punctuation as a ‘discrepancy’, the beneficiary can contact the opener either by fax or email and request him to advise opening bank to accept documents by overlooking and waiving such discrepancies.

You can also read more information by clicking Letter of credit - How does LC work? What are the advantages of Letter of Credit to Exporter? How LC is benefited to Importer? Are there any disadvantages to importer for a consignment under Letter of Credit? What are the disadvantages of LC to an exporter? Who are the parties involved in Letter of Credit? How to check authenticity of LC? What is Prime Banker? Yes, I am sure, once after going through those articles you will have a good knowledge about Letter of Credit.

I hope, you have satisfied with the clarification on spelling error and punctuation in documents under LC.

The above information is a part of Import Export Training online

Other post about import export cauching

Disadvantages of LC (letter of Credit) to Importer.

Disadvantages of Letter of credit (LC) for Exporter

Advantages of LC - letter of credit – to Importers.

Advantages of Letter of Credit (LC) for exporters

How Letter of Credit (LC) works

Difference between LC expiry and shipment date expiry

Can a Bill of Lading (BL) be predated for LC negotiation?

How to start Export Business?

How to get Export Orders?

What are the risks and solutions in Export Business?

Click here to know India Trade Classification(ITC)

Click here to know HS code of other product/commodity

Service Tax - Click here to read complete notification under Budget 2014

What is Bank post shipment credit to exporters?

Types of export containers

Measurement of export containers

Exim Policy of India 2015-20

MEIS, Merchandise Exports from India Scheme

SEIS, Service Exports from India Scheme

Merge your Commercial Invoice and Packing List for all your future exports

Export procedures and documentation

What is Tail Gate exam hold in US import clearance

How to make DA mode of payment safe

How to make delay in delivery of Shipment?

How to obtain a duplicate BL, if original bill of lading lost.

How to obtain GSP - Certificate of Origin?

How to obtain Phyto sanitary certificate. What is phytosanitary certification

What is THC - Terminal Handling Charges

What is the difference between BAF and CAF

What is the difference between High sea sales and imports

What is the difference between re-exports and re-imports

Transhipment - A redefinition

Types of Insurance Documents

Travelers to India under import duty exemption, Frequently Asked Questions Part 2

Triangular export

Triangular shipment

Types of Insurance Documents.

What is the earliest date can be mentioned on Bill of Lading. Can BL date and let export date be same day?

What is the Procedure for importing goods through Post offices in India

What is Third Party Exports? Difference between manufacturer exporter and third party exporter.

What is VACIS exam in US import customs clearance

When can an exporter release bill of lading from shipping company?

When does exporter get EP copy of shipping bill after customs clearance

Which category of exporter are you? Merchant Exporter,Manufacturer exporter,Service exporter Project Exporter or Deemed Exporter

How to make DA mode of payment safe

How to make delay in delivery of Shipment?

How to minimize import cargo clearance time? An open logic proposal to WTO

How to obtain a duplicate BL, if original bill of lading lost.

How to obtain GSP - Certificate of Origin?

How to obtain Phyto sanitary certificate. What is phytosanitary certification

How to obtain waiver on detention/ demurrage on imported goods/container from Shipping company/CFS

The information provided here is part of Export Import Online Tutorial