GST tariff on insurance auxiliary services concerning general insurance business

Click here to know GST rate for this service

The details about GST rate changes for sale of insurance auxiliary services concerning general insurance business are being updated here. The notification changes on exemptions for GST for sale of insurance auxiliary services concerning general insurance business and other circulars related to GST for insurance auxiliary services concerning general insurance business are updated in this website.

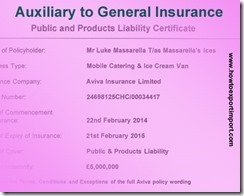

"Insurance Auxiliary Service" means any service provided by an actuary, an intermediary or insurance intermediary or an insurance agent in relation to general insurance business or life insurance business and includes risk assessment, claim settlement, survey and loss assessment;

"Insurance Auxiliary Service" means any service provided by an actuary, an intermediary or insurance intermediary or an insurance agent in relation to general insurance business or life insurance business and includes risk assessment, claim settlement, survey and loss assessment;

Goods and Service Tax (GST) rate tariff in India is designed in 6 categories of goods and services. Four main GST rate slabs framed with Essential goods and services, Standard goods and services and luxury goods and services with 5%, 12%, 18% and 28% respectively. Commonly used Goods and Services at 5%, Standard Goods and Services fall under 1st slab at 12%, Standard Goods and Services fall under 2nd Slab at 18% and Special category of Goods and Services including luxury - 28%. The most essential goods and services attract nil rate of GST under Exempted Categories. Luxury goods and services and certain specific goods and services attract additional cess than 28% GST.

Click here to know GST rate for this service

Click here to know GST rate on Goods and Services

GST Exemption list of goods and services

Find HSN number or Service tariff code for GST

GST registration guidelines

Indian GST Laws

How to export your goods?

Refund of GST tax on deposit under investigation

Refund of amount deposited for GST appeal

Finalization of provisional assessment under Goods and Service Tax refunds

Refund of GST tax on excess payment due to mistake or inadvertentce

When does GST tax to be refunded?

GST payments, list of Banks authorised in Centre and States

GST payment errors between GSTN and RBI

GST payments, claim of non delivery of service

Double payment error in GST tax payments

Payment of GST tax through fraudulent use

Issue of charge back in CC/DC Payment in GST payments

How to get Export Order?

GST Registration Guidelines

Learn Imports and Exports business free of cost

Find HSN code of your product.

How to export goods from India?

Commercial risks and solutions under Export Business

Political risks in International Trade

Risks arising out of foreign laws in Import Export Business

Cargo risks under Imports and Exports

GST scheduled rate on Processed fish business

Nil rate of GST on sale of Foliage without flowers or flower buds

Nil rate of GST on sale of Fish seeds

Nil tariff of GST on sale of Prawns

Nil rate tariff of GST on sale of chilled fish

Zero rate of GST on sale of Fresh fish

Nil rate of GST on admission, exam fee by an educational institution

GST taxable rate on purchase or sale of Frozen Fish

Zero percentage of GST on sales of Fish fillets and other fish meat fresh or chilled

No need to pay of GST on sale of Fish fillets and other fish meat

GST taxable rate on Dried, salted fish fit for human consumption business

Waived GST on purchase of cooked barnacles

Indian GST charges on Insurance Auxiliary Service provided by an actuary in life insurance business

Goods and Service Tax rate on Insurance Auxiliary Service provided by an intermediary in general insurance business

How much GST on Insurance Auxiliary Service provided by insurance intermediary in settlement claiming?

GST tax on Insurance Auxiliary Service provided by insurance agent in survey and loss assessment

Slab GST on Insurance Auxiliary Service provided by insurance agent in risk assessment