The information provided here is part of Export Import Training course online

How to calculate chargeable weight under airfreight in exports and imports.

Freight charge under air shipment is calculated on the basis of weight of cargo. Commonly a question arises here, whether actual weight or chargeable weight?

In an air  shipment, airfreight charge is calculated on the basis of actual weight or volume weight, which ever is higher. Then what is Volume weight? How to find volume weight?

shipment, airfreight charge is calculated on the basis of actual weight or volume weight, which ever is higher. Then what is Volume weight? How to find volume weight?

Chargeable weight is an equilibrium point where in actual weight and volume of cargo balance.

Why chargeable weight in airfreight?

Let me explain the importance of volume weight in airfreight. Why do air carrier balance weight and volume of cargo?

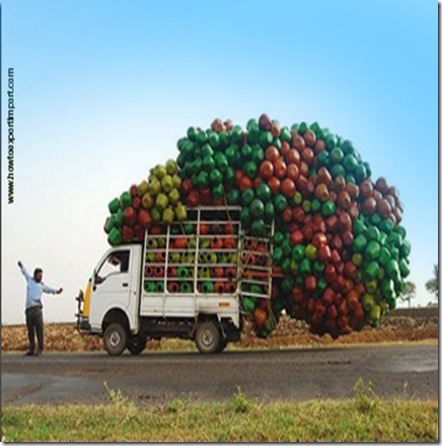

Let me explain the importance of chargeable weight in simple terms. If a shipper exports cotton, the actual weight of cotton is very low but occupies a good amount of space as a volume. In this case, if airfreight is charges on the basis of actual weight of cargo, the said shipper needs to pay a very nominal airfreight compared to a shipper who exports iron plates. Am I right? Here is the importance of volume weight by considering volume of cargo and actual weight of cargo at an equilibrium point.

Calculation of chargeable weight in airfreight.

In order to find volume weight of cargo you need to have measurement of package of goods.If the cargo measurement are in centimeters, the total volume of cm3 to be divided with 6000. In other words, if the volume is in cubic meter (CBM), the said volume in M3 to be divided with 0.006. Air carriers charge airfreight on the basis of volume weight or actual gross weight which ever is higher.

So the chargeable weight is calculated on the basis of volume weight or gross weight, whichever is highter.

Let me explain to calculate volume weight weight in simple language to make understand easily. I am going to explain with 3 examples, the method of calculation of chargeable airfreight for export shipments.

You have three shipments to be exported separately. Measurement of cargo length, width and height

Shipment 1:

Gross weight =750kgs

Measurement of cargo = 102cm X 98cm X 106cm = 1 box

80cm X 65cm X 103cm = 3 boxes

Total volume = 1059576 +(535600X3) = 2666376 cubic centimeter

Total volume weight = 2666376 / 6000 = 444.396kgs

Here in shipment No: 1, the gross weight is 750kgs and volume weight is 444.396kgs. Hence, Chargeable weight is 750 kgs which is also gross weight, 750kgs (which is greater)

Shipment 2:

Gross weight = 850kgs

Measurement of cargo = 120cm X 160cm X 115cm = 2 boxes

75cm X 130cm X 125cm = 2 boxes

Total volume = 4416000 + 2437500 =6853500 cubic centimeter

Total volume weight = 6853500 / 6000 = 1142.25kgs

Here in shipment No:2, the gross weight is 850kgs and volume weight is 1142.25kgs. Hence, airfreight is charged on the basis of volume weight, 1142.25kgs. Here, the chargeable weight is 1142.25kgs.

Shipment 3:

Gross weight : 950kgs.

Measurement of cargo = 1 meter X 1.05 meter X 0.85 meter = 2 boxes

0.7 meter X 1.50 meter X 0.60 meter= 3 boxes

Total volume = (0.8925 X 2) + ( 0.63 X 3)

1.785 + 1.89 = 3.675 cubic meter

Total volume weight = 3.675 / .006 = 612.50kgs

Although almost all airlines calculate volume weight on the basis of above calculation (6000), FEDEX calculate volume weight on the basis of 5000.

Here in shipment No:3, the gross weight is 950kgs and volume weight is 612.50kgs. Hence, airfreight is charged on the basis of actual gross weight of 950kgs which is greater than volume weight. So chargeable weight under this shipment no.3 is 950kgs. Also note, the measurement in shipment 3 is in meter and volume calculation also may be noted.

Also read - Why do carriers balance weight and volume while charging freight amount in Exports?

How to calculate CBM in LCL export shipments

I hope, I could explain in simple language about calculation of chargeable weight.

Would you like to share your experience in handling chargeable weight in air exports or air imports?

The above information is a part of Import Export Training course online

Write below your comments about chargeable weight.

Other details on how to import export

Why carriers balancing weight and volume while charging freight amount in Exports?

What is consolidation of cargo What is LCL cargo less container load cargo

What is Surrender of Bill of Lading

Consequences of wrong declaration of weight

Difference between DDU and DAP

Excise and Customs - Click here to read complete notification under Budget 2014

How to get Export Orders?

How to settle dispute in Exports and Imports?

Click here to know India Trade Classification(ITC)

Click here to know HS code of other product/commodity

Pre shipment bank finance to suppliers for exports through other agencies

Types of export containers

Measurement of export containers

Export Import Policy of India 2015-20

MEIS, Merchandise Exports from India Scheme

SEIS, Service Exports from India Scheme

Merge your Commercial Invoice and Packing List for all your future exports

Export procedures and documentation

Refund of Input Tax Credit (ITC) of GST, FAQ

Migration procedures for existing VAT payers to GST online in India

Refund of GST paid in India, FAQ

4 Conditions when applying for refund of Input Tax Credit (ITC) under GST

Enrolling an existing VAT taxpayers at the GST Common Portal

Difference between types of goods and services and types of GST

4 types of Goods and Services in India for GST rate

Difference between IGST on International goods and IGST on domestic goods.

Navigation controls to enroll with GST in India for existing VAT payers in IndiaHow is IGST calculated under Imports?

How is IGST rate on imports treated?

How to register a Digital Signature Certificate under GST in India.GST and e-Commerce Business, FAQ

Definition of E-Commerce under GST

How to identify the steps in enrolment process of a tax payer at the GST common portal.

TDS under GST, Frequently Asked Questions

Does Interest attract on GST Tax payment delay?

Step by step procedure to login with GST common portal in India

Mechanism of Payment of GST tax in India

Levy of late fee for GST Tax returns filing in India

I pay Service Tax on my services. But I am not sure how do I pay the new GST?

Notice to GST return filing defaulters

When to file Annual Return of GST online?

Changes of operation of SEZ

Does CVD exists under project imports?

Baggage clearance after GST implementation

Refund of SAD paid on imports

How to claim ITC under imports?

Union territory tax (Rate) Notification No. 46 of 2017 DT 14th November, 2017, GST

Integrated Tax (Rate) Notification No. 49 of 2017 DT 14th November, 2017, GST

Central Tax Notification No 40 of 2017 dt 13th October, 2017 under GST

CUSTOMS Notification No. 77 of 2017 dt 13th October, 2017

Integrated Tax Notification No. 10 of 2017 DT 13th October, 2017, GST

Minimized GST rates on Pots, jars and similar articles under HSN 6909